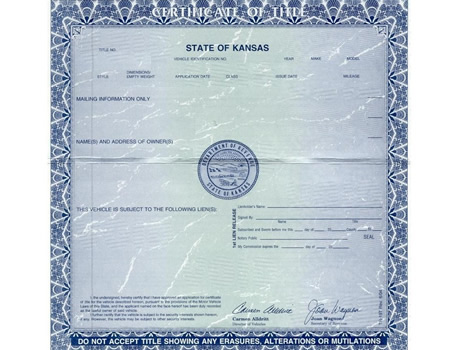

Kansas Mechanics Lien & Auto Title Services

Pursuant under the State of Kansas Lien Foreclosure Procedure Law --- Notice of a Mechanic’s Lien Foreclosure shall be provided to all Owner(s), Renewal Recipient(s) Person(s) on the Work Order, and Lienholders(s) with interest in a vehicle subject to a mechanics lien foreclosure.

Our IACP Certified Auto Appraisers at www.KansasMechanicsLien.com, a division of Houston Auto Appraisers, are highly trained to identify issues specifically related to your particular situation.

When filing a worker’s lien or filing a mechanic’s lien with the Tax Assessor-Collector of any county in the State of Kansas, you can depend on the fast and accurate mechanics lien services of Houston Auto Appraisers.

IF YOU HAVE A SIGNED WORK ORDER: When placing your order, please have the following information ready to provide to our IACP Certified Auto Appraiser in the mechanics lien foreclosure department:

- The vehicles VIN number as it appears on the Dash Board Only.

- The address of your shop where the repairs were made.

- The legal name of the person that holds the possessory lien, if available.

- Your taxpayer or employer identification.

- A signed copy of the work order authorizing repairs.

- The total amount due for the services rendered.

In the State of Kansas, a mechanic’s lien can be filed on Used Autos & Trucks, Classic Cars, Collectible & Special Interest Autos, Commercial Vehicles & Trailers, Farm Equipment, Yachts, Motorboats, Outboards, Jet Ski’s, Marine Equipment, Vessels, Motorcycles, Aircraft, Recreation Vehicles (RV's), Vans, Truck Conversions & Limousines only when a vehicle is repaired pursuant to a signed contract or agreement between a garage keeper and the vehicle owner or a person who has authority to contract for such services.

IF YOU DO NOT HAVE A SIGNED WORK ORDER: Disposal of the vehicle must be by court order through a county or district court or through a County Tax Assessor-Collector Hearing. Houston Auto Appraisers can represent your Mechanic Shop in court should this be your only option.

For Release of Lien / Add a Mechanic’s Lien, contact www.KansasMechanicsLien.com

Possession of the Vehicle:

If possession of the vehicle was released for a payment that was stopped or dishonored because of insufficient funds: The person claiming the lien is entitled to repossess the vehicle if the work order or contract has a statement that says THE VEHICLE IS SUBJECT TO REPOSESSION in boldface, capitalized, underlined or in a conspicuous manner with a separate line. The workers lien claimant may include the repossession fee to the original amount due. KansasMechanicsLien.com can help you with other DMV motor vehicle problems including:

- Auto Title, Registration, Plates, and Bonded Titles

- Commercial Vehicle Registration / Kansas IRP / Apportioned Plates

- Storage Liens for Abandoned Vehicle or Private Tow

- Justice of the Peace Orders

- Aircraft Repair and Maintenance Liens

- Abandoned Vehicles

- Storage Fee’s

- Junked Vehicles

- Public Nuisance Vehicles

- Lien for vehicle’s dropped off by Law Enforcement